by Dan Dunbar | Oct 24, 2019

The United States has a multi-layered income tax system. That means taxes are imposed by federal, state, and local governments. Federal and state income taxes are similar in that they apply a tax rate to taxable incomes. Indiana counties impose their respective county...

by Dan Dunbar | Sep 12, 2019

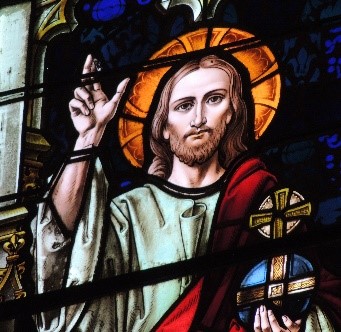

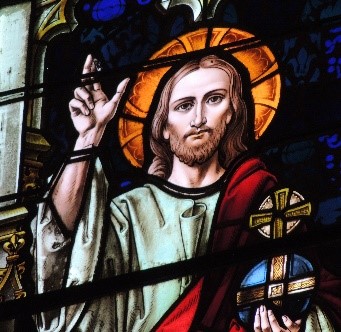

Resulting from the Tax Cuts and Jobs Act of 2017, it is more difficult to claim the tax deduction for charitable contributions. However, there are techniques available to plan your giving to hold on to the popular tax break. Being charitable is often its own reward....

by Dan Dunbar | May 24, 2019

Not everyone knows that just because their federal income tax return is completed and filed, they aren’t done with it. No, don’t just toss the return and all the tax records in the shred bin and walk away. It is important to retain the documentation that supports the...

by Dan Dunbar | Apr 2, 2019

One of the little joys in life is getting – or giving – a gift. There are all the traditional gift-giving events such as birthdays, holidays, new babies, weddings and the like that everyone has participated in by giving or receiving. But there is another kind of gift...

by Dan Dunbar | Mar 12, 2019

A Health Savings Account (HSA) is a tax-advantaged account designed for people with certain types of health insurance plans to save for medical expenses. One of the important differences between an HSA and a flexible spending account, or FSA, is that you aren’t...